EPBD: Reinforce the deployment of smart charging functionalities

The development of smart charging and bidirectional charging (V2G) in buildings is an opportunity for EV users. It provides a superior charging experience and reduces the consumers’ electricity bill. Indeed, in France, on average with V2G, the annual cost of recharging an electric vehicle is 240€/year, compared to 420€/year without smart charging functionalities.[1] The Commission has recognised, in its AFIR Impact Assessment, that every smart recharging point could on average create a system benefit of more than 100€/year by 2030.[2] Smart charging also reintegrates electricity surpluses into the grids (V2G) and/or reuse it in the buildings (V2B) and homes (V2H), as well as supporting the uptake of electromobility. It can also create synergies with renewable energies, by integrating them into the electricity grids and providing flexibility services to the system. Furthermore, smart charging complements the right-to-plug by ensuring that charging points optimise the use of the grid capacity of a building and removes the argument that grid connections need to be reinforced.

Key recommendations:

- Ensure that all newly installed chargers in buildings are capable of smart charging.

- Ensure consistency in the definitions and provisions on smart charging set in the revision of the EPBD with those proposed in the new Regulation on the deployment of alternative fuels infrastructure - which is replacing the current AFI Directive 2014/94/EU (in Art. 2 and 5) - and in the revision of the Renewable Energy Directive.

- Ensure the recognition of mobile storage in the European energy framework.

- Clarify that bidirectional charging (Art. 12. 6) should be encouraged when demonstrating a positive socioeconomic impact and contributing to system efficiency. Co-legislators should also address any remaining barriers for vehicle-to-grid technologies.

[1] [In French] RTE (2019), Report on the development of electromobility.

[2] AFIR Impact Assessment, Annexes, page 86.

EPBD: Completing the charging requirements for new and under major renovation buildings.

Completing the charging requirements for new and under major renovation buildings.

The Platform asks to complete the charging requirements for new buildings and buildings undergoing renovation in order to mandate the deployment of smart-charging ready recharging points in all new and existing buildings.

Key recommendations:

- Include depot charging for heavy- and light-duty vehicles, i.e. extending the scope of the EPBD to cover new or renovated private depots, as well as logistic hubs and distribution centres. This would require them to be ready for future battery electric truck charging (350 kW+ chargers), so that trucks can conveniently charge while loading/unloading. This should include pre-equipment, as well as an appropriate grid connection.

- Charging facilities for e-bikes should match those for e-cars. There are two options:

- recharging points for electric vehicles would be equipped with a household power socket, allowing for the easy charging of both e-bikes and e-scooters as well as certain types of L-category vehicles such as e-mopeds, or

- deploy a separate bicycle charging infrastructure, with dedicated bicycle recharging points.

- The requirements should apply to all buildings that are undergoing a major renovation, regardless of whether the car park is included in the renovation measures.

- Greater ambition for parking spaces for non-residential buildings; there should be a minimum of 50% of parking spaces with charging points.

EPBD: Ensure charging solutions in existing buildings.

Some 80% of the EU’s current building stock will still be in use by 2050, with the average annual major renovation rate just 2.7% for non-residential buildings and 1.5% for residential buildings.[1] As a result, the EC should ensure the installation of charging points in existing buildings.

Key recommendations:

- Extend the scope of Art. 12 to ensure requirements for installing charging points in existing buildings. Incentives or enforcement mechanisms, to make sure that the stakeholders involved comply, should be introduced.

- Avoid putting a disproportionate burden on building owners and tenants, by addressing the necessary elements to reduce the costs of private charging installation.

- Introduce per-cabling requirements for existing buildings:

- 2027: all parking spaces in 15% of all buildings

- 2030: all parking spaces in 30% of buildings (100% for all publicly owned buildings)

- 2035: all parking spaces in all buildings.

- More ambitious charging point requirements for non-residential buildings (15% of parking spaces (2030), 30% (2035) applicable for all buildings with more than ten parking spaces.

[1] EPBD Impact Assessment.

Zoom in on the deployment of charging infrastructure in France

Zoom in

the deployment of charging infrastructure in France

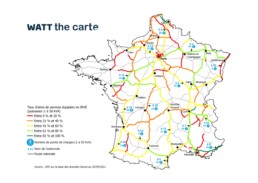

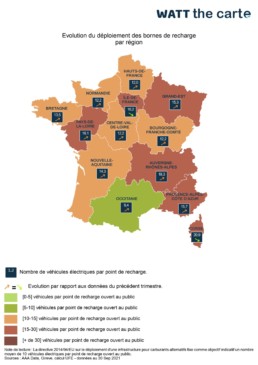

The French government set ambitious objectives for the deployment of charging stations to deploy 100,000 charging points (CPs) by the end of 2021 and to equip all service areas on the highways with fast charging stations by 2023.

To know where to go, we need to understand where we are. This is why, UFE has launched two mapping tools, updated every 3 months, that aim to follow the state of deployment of the public CPs in France.

- Mapping 1 reflects the deployment of publicly accessible charging infrastructure in the French regions and departments since September 2020.

- Mapping 2 shows the (ultra-) fast CPs on the French conceded highway network since March 2021.

Methodology[1]

Mapping 1 indicates the number of EVs available for 1 CP per region and department, with reference to the ratio of 1 CP per 10 EVs set by the current Alternative Fuels Infrastructure Directive (2014/94/EU). Mapping 2 assesses the equipment rate of the service stations in at least 50-kVA CPs for all motorways operated under a concession.

Where does France stand at the end of September?

France has acquired around 46,300 CPs and 660,000 electric vehicles in circulation since 2010. Over the past year of monitoring the CPs’ deployment in regions and departments, the number of CPs has increased by 42%, while the EV fleet has grown by 78%. Even if the number of CPs keeps increasing gradually every 3 months, the threshold of 1 per 10 has been exceeded in all regions except Occitanie.

As for CPs on the highway network, (ultra-) fast charging has increased by 9% in France since June 2021 or by 42% in 6 months. 55% of the highways were equipped with at least one fast CP equal to or greater than the 50kVA.

Conclusion

UFE’s mappings show that, while the country is on the right track, more efforts are needed to reach the objectives set by the government for the deployment of public CPs in regions and departments. In this respect, the new AFIR could give France the final boost it needs with the right targets.

[1] AAA Data’s (electric vehicles) and Gireve’s (charging points) figures for UFE

General internal information

Contact list here (contact secretariat for first access)

Plenary meetings

Studies

Outreach meetings

![20211022_ECF_Results Presentation[14] 20211022_ECF_Results Presentation[14]](https://www.platformelectromobility.eu/wp-content/uploads/_pda/2021/12/20211022_ECF_Results-Presentation14-thumb.png)