2024 Election Manifesto

PLATFORM’S MANIFESTO FOR THE 2024 EU ELECTIONS

2024-2029: Five Years to make the e-mobility transition a Success

The agreement to pursue zero emissions for Europe’s new cars and vans by 2035 backed up by strong charging infrastructure and development of alternatives such as rail network, and the sustainable batteries regulation, has set a clear direction and an unequivocal target for sustainable transport measures.

However, in order to make the Green transition a reality, and bring its benefits to people, the planet and business, it is vital that we act now. Making the transition to e-mobility must be a priority, not simply to deliver environmental sustainability but also to reinforce the EU’s industrial strength, security and competitiveness.

Time to put the Green Deal into action

● The support of the legislative efforts and ambitions of the EU Green Deal and notably The agreement to pursue zero emissions for Europe’s new cars and vans.

● Now it is time to implement those ambitions to reduce Europe’s dependency of fossil fuels, make it a global leader in the sustainable transport industries and priorities quality of life and workspace for Europeans.

● An effective green industrial policy will bring the benefits of Europe’s Green Deal to all.

1st Pillar

A Green and Just Industrial Policy

● Creating an integrated recycling industry ecosystem in Europe.

● Smartening and upgrading existing grid infrastructure to allow it to support greater levels of renewable energy.

● Ensuring strong end-of-life vehicles regulation, focused on low carbon and recycled materials.

2nd Pillar

Investment Plan to implement the Green Deal

● Making it easier for green energy transition sectors to access current EU funding mechanisms.

● Deploying infrastructures to support zero-emission passenger and freight transport across Europe.

● Introducing a dedicated budget for urban nodes, to avoid cities becoming a weak link.

3rd Pillar

People at the heart of the e-mobility ecosystem

● Supporting reskilling programmes to attract workers from traditional industrial sectors and aiding their transition into these emerging sectors.

● Enabling Vehicle-to-Grid (V2G).

● Mandating electric vehicle adoption in corporate fleets.

"It’s time to look ahead and see how the next legislative mandate can put the Green Deal into action. The agreement to pursue zero emissions for Europe’s new cars by 2035 has set a clear direction but this trajectory now needs to be implemented right."

— Julia Poliscanova, Vice-Chair Platform for electromobility

Ten truths about electric trucks and buses

Lice-cycle GHG emissions

Battery electric trucks have the lowest life-cycle GHG emissions

This is true from 16-40t trucks, according to a study by Ricardo Research (2020), which compared emissions of the differing drivetrain technologies based on a WTW approach. The emission-saving potential of electric vehicles (EVs) increase when entirely powered by renewable energy (up to 81%) compared to a fossil-powered alternative as shown by study ICCT (2021) undertaken in passenger cars. As battery-eletric trucks (BETs) have outstanding energy efficiency, lifecycle emissions decrease with every additional kilometre driven, meaning that long-distance trucks have particularly high emission-saving potential.

Energy efficiency

Battery electric trucks offer a dramatic improvement of energy efficiency

BETs offer a dramatic improvement of energy efficiency, i.e. the ability to drive a greater number of kilometres on the same amount of energy. The JRC, EUCAR and Concawe (2020) have updated their joint evaluation of the WTW energy use and Greenhouse gas (GHG) emissions for a wide range of powertrain options. Considering only zero-emission technologies on Wheel-to-Well (WTW) basis, BETs using green electricity - both regional and long-haul - are 2.6 times more energy efficient than the green hydrogen-powered fuel cell equivalent. Although synthetic fuels were evaluated for cars rather than trucks, as an indication a battery electric car using green electricity is 6.9 times more energy efficient than a combustion vehicle using e-fuel.

GHGs and air pollutant

Battery electric buses do not produce local GHGs and air pollutant emissions

Battery-electric buses (BEBs) do not produce local GHGs and air pollutant emissions, providing considerable health benefits, particularly in cities. Because they are powered by electricity, the higher powertrain efficiency means that BEBs emit 73% less CO2 equivalent than diesels, rising to 90% if powered by 100% renewable sources. In contrast (according to ICCT (2022)),Compressed Natural Gas (CNG) CO2 emissions are nearly 30% lower than a diesel, but its higher energy consumption - 24-50% per kilometre - reduces this advantage. In addition, methane is a potent GHG with a global warming potential more than 80 times greater than CO2 over a 20-year period; unintended leakages during extraction and transport further exacerbate the situation.

Intermodality

BETs will contribute to the further greening of intermodal transport

BETs will contribute to the further greening of intermodal transport, as well as improving the overall energy efficiency of freight logistics. Synergies between rail, road transport and inland waterways are crucial to the logistics system. These offer benefits for the whole supply chain, as intermodal transport helps reduce congestion in urban areas while potentially increasing capacity in and around cities. Tangible examples of intermodal links have been successfully deployed in Paris’ metropolitan area. Companies such as IKEA and Franprix supply stores in Paris are using a combination of electric ships and electric road transport solutions for the last-mile segment.

Electricity grid

With smart grid technologies, the grid would need little adaptation for BETs and BEBs.

With smart grid technologies, the grid would need little adaptation for BETs and BEBs. Uni- and bi-directional charging enables a double optimization of the load at the depot. Optimising the grid connection and allowing the monetisation of the vehicles' flexibility capabilities makes them valuable assets, even when parked: it also provides the grid with supplementary battery capacity. Vehicle-to-grid (V2G) is performed at much lower power levels than in regenerative braking or fast charging.

Cost

By 2030, 99.6% of new BETs will be cheaper to own and run than diesel trucks

By 2030, 99.6% of new BETs will be cheaper to own and run than diesel trucks while carrying the same weight of goods over the same distance and journey time, according to a study by TNO (2022). This study is based on the total cost of ownership (TCO), the most important economic indicator for a truck. It covers those deployed in urban and regional delivery over distances of 300 km as well as long-distance trucks travelling 800km/day. Due to the savings from using electricity rather than diesel, the cost-saving potential of BETs increases with every additional kilometre driven, meaning that by 2035, long-distance trucks will be the most cost-efficient solution in Europe.

Investment costs of battery elecric buses

Higher investment costs of BEBs offset by lower electricity consumption and maintenance costs.

Similarly, the higher investment costs of BEBs are offset by their lower electricity consumption and maintenance costs (in Spain and Latin America in 2021 and in Italy, US and UK by 2023). Bocconi University and Enel Foundation (2021) integrated well-known TCO (the initial investment in purchasing vehicles and the charging infrastructure, plus the operational and maintenance costs) with peculiar to BEBs circular economy revenue streams, by the second life of batteries and V2G. This explains why buses are now the fastest-growing zero-emission vehicle segment, making up 23% of new city buses in 2021, up from 16% in 2020. Considering the revenues from V2G and second life, BEBs are more cost effective than diesel and CNG buses.

Payload

Urban and regional trucks can already have as much payload capacity as their diesel counterparts

Urban and regional trucks can already have as much payload capacity as their diesel counterparts today, according to a recent study by TNO. While the battery of an electric long-haul truck currently may weigh several tonnes, depending on its size, the so-called 'ZEV weight allowance' grants an additional two tonnes to zero emission trucks on European roads. This, along with improving vehicle energy efficiency and battery energy density, will eliminate any payload loss by the end of the decade, even for long-distance trucks with 800km range.

Range

BETs already have more than sufficient range to cover freight transport routes in Europe

BETs already have more than sufficient range to cover freight transport routes in Europe, something that will continue to improve. With the compulsory 45-minute break every 4.5 hours, and given that they have a maximum permitted speed of 90km/h, trucks will never drive more than 400 km without having to stop. Tesla has begun deliveries of the ‘Tesla Semi’, a clean-sheet design BET with a real-world range of 800km when fully loaded. The EU’s Weights & Dimensions Directive allows ZETs to be increased by two tonnes over that of diesel trucks. This allowance alone already increases the payload-neutral range of electric trucks by over 300km.

Extreme conditions

BETs are as competent as diesel trucks in extreme cold.

BETs are as competent as diesel trucks in extreme cold. In February 2021, Volvo Trucks, ABB and Vattenfall - together with a local mining company - ran a trial on replacing the diesel transport of iron ore with BETs. The ore is taken from a North Sweden mine to the railway transfer station, in temperatures of -30C°. The BETs were used for the journey from the mine to the transfer station where they could unload the cargo while recharging batteries following a 280km round trip normally undertaken by diesel-powered vehicles. The Polar Winter Project proved the feasibility of electric transportation in extreme conditions. The BETs were able to drive the entire distance - including 140km with 14t of ore on board, at temperatures as low as -32C° - while taking the same amount of time as the diesel trucks.

BET Battery Electric Truck

GHG Greenhouse Gas

EV Electric Vehicle

WTW Wheel-to-Well

BEB Battery Electric Bus

CNG Compressed Natural Gas

V2G Vehicle-to-Grid

HDV Heavy-Duty Vehicle

LFP Lithium iron phosphate

TCO Total Cost of Ownership

ZEV Zero-Emission Vehicle

ZET Zero-Emission Truck

JRC Joint Research Center

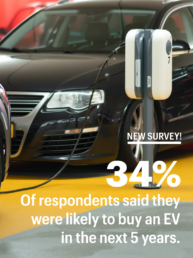

New consumer study shows that the EV transition is inevitable

New Study

European consumers want electric vehicles

The Platform for electromobility – representing more than 45 organisations from industry, civil society and cities, and across all transport modes – released a report carried out by Element Energy on consumer’s perception on the shift to electric vehicles (EV). The study, which surveyed 14,000 new car buyers across Europe shows that consumers are ready to move to electric.

Our policy recommendations

Significantly strengthen CO2 standards for passenger cars and vans targets

The importance of upfront cost in unlocking massive EV uptake highlights the need for ambitious regulation on CO2 Standards for cars and vans to ensure production scale up during the 2020s. An ambitious legislation will increase the offer and promote the market uptake of zero-emission vehicles. With an increased market, zero-emissions vehicles will also become more affordable at purchase price with a continuously reduced total cost of ownership and more choice for consumers and will also help tackle air quality and noise issues, bringing an overall benefit to society. As detailed above, the study confirms the feasibility of new proposed interim targets will be met by strong consumer demand.

Under the CO2 standards for passenger cars and vans, introduce a new provision to electrify corporate fleets

The study demonstrates the importance of corporate fleets in driving markets for electric vehicles. The Platform for electromobility therefore proposes to mandate the decarbonisation of corporate cars by 2030. In a previous communication, the group outlined the environmental and social benefits which such an EU-level mandate could bring. One major motive is for the EU to act quickly and decisively electrify a segment representing over 60% of vehicles sales in Europe and subsequently create a sufficient second-hand market by 2035 as most private consumers use this channel. To enshrine electrification objectives for corporate fleets in EU law, the Platform support the proposition by Rapporteur Huitema to revise the Clean Vehicles Directive (CVD). Its scope could be extended to corporate fleets as part of the revision of the CO2 Standards for cars and vans Regulation.

Do not introduce fuel crediting in the CO2 standards for passenger cars and vans

The study shows e-fuels as a dead-end solution for consumers. Even at a seemingly unreachable price parity with BEVs, consumers would still opt for the electric option. The Platform is opposed to introduction of a fuel crediting mechanism that would consider the contribution of renewable and low carbon fuels in the compliance assessment for each manufacturer. Policies focused on decarbonising fuels and those focused on reducing emissions from cars and vans must remain in separate legal instruments.

Under the Alternative Fuels Infrastructure Regulation, we need more ambitious targets for EV uptake

The Platform for electromobility believes the Commission’s AFIR proposal is a good start but, to ensure charging points keep up with the EV uptake, the level of ambition of the mandatory targets for light-duty vehicles must be doubled. For long distance journeys, the targets for the TEN-T comprehensive network should be brought forward to 2025.

The Energy Performance of Buildings Directive should facilitate the access to private charging

The revision of EPBD must ensure the right-to-plug to all EV users in order to facilitate the installation of charging infrastructure for tenants and properties under shared ownership. Drivers willing to make the transformation often face diverse obstacles: latency between requesting a charger and installation, installation of charging infrastructure for tenants and properties under shared ownership, lack of electrical pre-equipment in collective electrical installations etc. Smart charging is also required in all types of buildings as it provides benefits to both the power sector and the EV users. The revision of the Energy Performance of Buildings Directive is therefore very timely to address those challenges and ensure a minimum level of charging points in all off-street parking lots.

Our key findings and recommendations to make the European Green Deal an employment success

Executive Summary of the study “E-mobility: a green boost for European automotive jobs?” for policy makers

The Platform for electromobility has facilitated a report (and data set) – undertaken by the Boston Consulting Group – on the impact of the shift to electric vehicles production on automotive jobs in Europe. The Platform for electromobility represents 45 organisations from industry, civil society and cities that employ around 650,000 people globally.

This study takes a deep dive into the likely opportunities and challenges that will be created by the transformation of the automotive industry in the coming 10 years. Ensuring that workers are guided and accompanied through this transition will be the key to the success of the industry and to preparing them for the jobs of the future.

Key findings: a comprehensive and inevitable transformation

The automotive industry was deeply impacted by the COVID-19 crisis, and will likely need several years to reach pre-pandemic levels of production and profitability. Prior to the pandemic, manufacturers were producing approximately 17.7 million light vehicles in Europe with an overall production value of approximately €700 billion.

The study shows that the industry will rebound, with a shift from internal combustion engines (ICEs) to electric vehicles (EVs). By 2030, some 59% of sales in Europe will come from electric vehicles (70% if plug-in hybrids are included). Alongside electrification, digitalisation will be the second pillar underpinning the carmakers’ recovery: the study projects that the value of software included in cars will increase by 11% each year. Based on the projected volumes of production and sales for 2030, the study concludes that – across the 26 industries within scope of the research, which represent 5.7 million jobs – overall employment is forecast to remain essentially stable compared to the 2019 baseline, with minimal variations in job numbers. Although electrification will contribute in part to these slight variations, the study predicts that EVs will have only a minor net impact on jobs through to 2030, contrary to what some observers expect.

This relatively small net figure should not, however, obscure the massive structural changes resulting from the shift to electrification. Changes in production will modify both the skills requirements and distribution of labour. Over the decade, direct employment in carmakers and ICE-focused suppliers will decrease by 5%, while adjacent industries’ workforce – such as those in energy production and charging infrastructure – will increase by 34%. This transfer from core automotive industries to adjacent industries is examined in detail in the report. It shows that – with more than 580,000 new jobs created by shift to EVs – production of these vehicles will be the main driver for job creation in the automotive ecosystem.

On top of these jobs, a further 40,000 will be created each year by construction and civil works for adapting energy production and distribution infrastructures. Without the shift to EVs, these economic opportunities would not exist at all. The study also expects electromobility to act as a catalyst for further activities in other adjacent sectors to the automotive industry. In the energy domain, we expect 60,000 new jobs to be created.

Overall, the effects on employment in the core automotive sectors caused by the product changes arising from the EV shift will be compensated for by new opportunities created by the electromobility ecosystem. These will be driven, for example, by growth in battery production and charging infrastructure. This finding is all the more significant given that a failure to electrify would likely lead to competitive disadvantages and subsequent significant job losses across European industry.

The report estimates that, by 2030, 2.8 million workers will need to be hired and the job profile of 2.4 million positions will change, with different degrees of training needs to prepare them for future job demands. By 2030, 42% of all employees in the core automotive and adjacent industries will have dedicated training needs. Specifically, 1.6 million will require retraining, while remaining in their current position; another 610,000 will need requalification while remaining in the same industry cluster; 225,000 people will need support to requalify for work in other industries outside the automotive ecosystem. Some of this impact will be felt at local or regional levels, so it is vital that governments provide policies to help those regions adapt to the coming change.

Our recommendations: The need for a robust framework to master the transition

The transition to electromobility does not pose a threat but rather an upskilling opportunity for workers. With the correct political and regulatory choices, the outlook is bright for one of Europe’s strategic industries and its workforce.

It is vital to support workers during this transition to electromobility: the EU, governments and companies should prioritise programmes that invest in the education, training, upskilling and reskilling of the labour force to capitalise on new opportunities, raising the bar on employment conditions, to ensure no one is left behind. This will be an investment for future generations and for the environment.

The Platform welcomed the ambitious ‘Fit for 55’ package unveiled in July, but the social changes this will trigger should be tackled with similar levels of ambition. A fair Green Deal must empower companies, governments and regional authorities to equip the workforce with new skillsets.

European Institutions: Workers in the automotive sector should benefit from a policy framework similar to that already flourishing in the energy-intensive industries, thanks to the Just Transition Fund, Just Transition Platform and Just Transition Mechanism. This new policy framework should assist industrial stakeholders, local, regional and national authorities in accomplishing the following steps:

Industrial stakeholders: For employers – and notably carmakers – support will be needed to design requalification and upskilling programmes and hiring as well as restructuring programmes. Battery manufacturing and the deployment of infrastructure both for distribution via charging stations and production via renewable energy will be a core provider of jobs during this transition. Their rapid growth should be underpinned by ambitious regulations and targets. Support should be provided, particularly for small- and medium-sized enterprises during the transitions, as they will lack the analytics and training resources of bigger companies.

Local and regional authorities: Behind these numbers lie human lives and territories where they live. Relocations should thus be avoided where possible by adapting existing production plants, and training for new skills where they are needed. Local and regional authorities will play a key role in addressing the knowledge gaps in the workforce both for EV production and for the full EV system and value chain. The new ESF+ should be an instrument for supporting local and regional authorities in this field.

National governments: Governments need to perform holistic, ‘whole-of-economy’ workforce planning at a national level. This needs to be done in close cooperation with regional and local authorities as well as industrial stakeholders, and must include advanced models for supply and demand, such as:

- Helping employees manage their transitions. It is essential to rethink education and reskilling and provide additional initiatives; the main challenges, such as the need to requalify workers for a different industry, should receive the highest priority.

- Tailoring educational curricula appropriately. For young people entering education, Governments will need to gear them – and for job seekers – towards new automotive technologies.

- Building new career and employment platforms. The public sector should help workers to navigate to jobs and training opportunities more quickly and easily.

- Updating social safety nets. These will need to be revised in order to promote up- and re-skilling during transitions, as well as supporting part-time workers and those people unable to adapt to new challenges.

They reported our study:

-

Reuters: https://www.reuters.com/article/autos-europe-electric-jobs-idINKBN2GN26J

-

Politico : https://pro.politico.eu/news/politico-pro-morning-mobility-vw-compensation-pressure-imo-climate-neutrality-call-fit-for-55-costs?utm_source=POLITICO.EU&utm_campaign=bfe97b311b-EMAIL_CAMPAIGN_2021_09_29_04_59&utm_medium=email&utm_term=0_10959edeb5-bfe97b311b-190774208

-

Ends Europe : https://www.endseurope.com/article/1728880/ev-transition-will-minor-impact-total-auto-jobs-study-finds

-

Euractiv: https://www.euractiv.com/section/electric-cars/news/shift-to-evs-means-huge-reskilling-job-for-europe-report/

-

Automotive News Europe: https://europe.autonews.com/automakers/shift-evs-means-huge-reskilling-job-europe-study-says?utm_source=daily&utm_medium=email&utm_campaign=20210928&utm_content=hero-headline

-

Yahoo Finance: https://au.finance.yahoo.com/news/shift-evs-means-huge-reskilling-220920083.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr&guccounter=1&guce_referrer=aHR0cHM6Ly90LmNvLw&guce_referrer_sig=AQAAAJrlwm12aslHP0qvGsu8voim-hoYJP2N9ur-AIvpgwL_Od1kwmrZUxk8yoc0amUzdOmXbfK66OWJ9jy0G1vdaLp9GesVGoKUybo_vJjaTEJ5YBosvGpbArsBwezSDMOcmW61uC4zosOHkYjW3Qxl44tzETmYU5DVyJqIfLevbmFx

Denmark

China:

-

MSN: https://www.msn.com/zh-tw/money/topstories/%E6%A2%85%E5%85%8B%E7%88%BE%E5%9C%A8%E4%BD%8D16%E5%B9%B4-%E5%BE%B7%E5%9C%8B%E6%95%B8%E4%BD%8D%E6%95%99%E8%82%B2%E5%8C%B1%E4%B9%8F-%E6%8A%80%E8%A1%93%E8%90%BD%E5%BE%8C%E7%89%B9%E6%96%AF%E6%8B%89/ar-AAOTh2w

-

Technews: https://technews.tw/2021/09/28/merkel-reigned-for-16-years/

-

Shenzen Daily: http://www.szdaily.com/content/2021-09/29/content_24610041.htm

UK

-

UK Investing: https://uk.investing.com/news/commodities-news/shift-to-evs-means-huge-reskilling-job-for-europe--report-2472496

-

Business Fast: https://www.businessfast.co.uk/shift-to-evs-means-huge-reskilling-job-for-europe-report/

Italy

InsideEV Italia : https://insideevs.it/news/536915/auto-elettrica-posti-lavoro-bcg/