Invest skills for competitive, sustainable, European transport industries

Net Zero Investment Plan

Area 6: Invest in skills and workforce (10.5%)

Unlocking Europe’s decarbonization potential requires mapping training needs, expanding training capacity, and launching awareness campaigns to cultivate a skilled workforce for sustainable transportation.

Investment Areas

Skills and Workforce Priorities

Mapping training needs and training capacities

Increasing existing training capacity

Awareness Campaigns

Developing a skilled workforce is essential for successfully decarbonising the transport sector. Addressing skills shortages, promoting job creation and enhancing training capacity are key priorities requiring coordinated efforts from the EU institutions, Member States and industry stakeholders.

- Mapping training needs and training capacities

The EU institutions and Member States must undertake a comprehensive skills mapping exercise to identify gaps and assess the needs for jobs and skills in various sectors. This should encompass both the traditional and new skills required to deliver decarbonisation. Based on the gaps identified, tools should be developed to publicise available training opportunities and instigate new training programmes where necessary.

- Increasing existing training capacity

To meet the growing demand for skilled workers, there should be investment in increasing training capacity, including improving Vocational Education and Training (VET) schools and recruiting suitably qualified teachers. Urgent action is needed to address the time required to adequately train workers, in order to ensure the steady supply of skilled labour for industries transitioning to sustainability. By enhancing training infrastructure and resources, Europe can build a workforce with the ability to advance the energy transition. Initiatives such as the ‘Net-Zero Academy’ can serve as role models for supporting skills development initiatives across Europe.

- Awareness Campaigns

Investment in awareness campaigns is crucial for attracting greater numbers of workers to technical jobs and education, particularly in those sectors undergoing energy transition. Such campaigns should target young people, to cultivate their long-term interest and engagement in sustainable professions. By raising awareness of the opportunities available in decarbonisation sectors, Europe can inspire the coming generation of skilled workers and drive innovation in clean technologies.

Invest in manufacturing for competitive, sustainable, European transport industries

Net Zero Investment Plan

Area 5: Invest in ‘Made-in-Europe’ manufacturing (14.9%)

Efficient processing methods, increased R&D funding for sustainable battery development, support for EV and battery manufacturing, and refurbishment or manufacturing of zero-emission trains are vital for advancing the e-mobility industry in Europe, promoting sustainability, innovation, and economic growth.

Investment Areas

Manufacturing Priorities

Processing

Research & Development

EV Manufacturing

Battery Manufacturing

Zero Emission Trains Refurbishment

Zero Emission Trains Manufacturing

- Processing

Efficient and sustainable processing methods are integral to the preparation of raw materials for manufacturing components central to the emobility industry, such as batteries. This encompasses transforming raw materials – via various processes – into the specific forms required for producing batteries and other components. Ensuring the environmental responsibility of these processes is paramount for establishing a stable and ethical supply chain for the EV sector.

- Research and Development

Funding is essential to advance battery R&D for e-mobility. Transitioning away from per- and polyfluoroalkyl substances (PFAS) is imperative for achieving full sustainability and futureproofing the industry. R&D funding, particularly for PFAS alternatives and battery development, is crucial for driving innovation and improving environmental performance. Strategic investment in R&D to consolidate European technology champions will enhance the competitiveness of European industries in the global market.

- Support for EV & 22. Battery Manufacturing

The development of battery production is crucial for reducing European industry’s dependence on Asia and the USA. Additionally, it presents an opportunity to create attractive employment opportunities. Supporting the growth of battery manufacturing not only strengthen Europe’s industrial base but also fosters innovation and economic growth. By investing in EV and battery manufacturing, Europe can become a leader in sustainable transportation and create a booming ecosystem of green technologies. In addition, it offers an opportunity to create attractive employment opportunities.

- Zero-Emission Trains: Refurbishment or 24. Manufacturing

The lack of rolling stock in Europe presents a significant barrier to expansion, particularly for new market entrants and operators seeking to launch innovative rail services. Refurbishing, retrofitting and manufacturing new rolling stock that meets the evolving needs of passengers, such as comfortable night trains and high-quality internet connectivity, is essential for accelerating behavioural change and promoting the widespread adoption of zero-emission trains. It is worth mentioning that the European Smart and Sustainable Mobility Strategy rail objectives are set at doubling by 2030 and tripling by 2050 high-speed rail traffic and increasing by 50% by 2030 and doubling by 2050 rail freight traffic. Achieving these ambitious goals, which are interlinked with the completion of the EU TEN-T rail network and the EU 2040 emissions reduction target, will require a considerable increase in the EU’s production capacity of (very) high-speed and freight rolling stock by 2050.

Five steps towards a 360° e-mobility industry strategy

EU Industrial Strategy

Our recommendations for a “Green Deal Industrial Plan”

Any “Green Deal Industrial Plan” would not be complete without a strong chapter on the electromobilities manufacturing ecosystem.

In the context of the forthcoming EU legislative mandate, the Platform for electromobility endorses the overall shift in European policy priorities set by the European Green Deal as a welcome long-term compass. Recent institutional declarations[1] aligned with Platform’s EU Election Manifesto[2] support the development of a robust industrial policy. This is essential to ensure Europe’s competitiveness, resilience in a rapidly evolving global landscape, and maintain its leadership in climate change mitigation. Any “Green Deal Industrial Plan” would not be complete without a strong chapter on the electromobilities manufacturing ecosystem. To achieve these goals, we propose a multifaceted approach that considers the entire value chain’s competitiveness in green transport solutions while revitalizing their financial support. Such policies must be implemented within a framework of regulatory stability and close international cooperation with other regions.

We will set out these proposals below under 5 headings:

- Ensuring regulatory stability for industries and investors

- Enhancing value chain competitiveness and resilience

- Financing the transition in the short term: the “low hanging fruits”

- Financing the transition in the long term: Net Zero Investment Plan

- Strengthening international cooperation

We welcome questions and cooperation with the Platform for Electromobility on our proposals.

1. Ensuring regulatory stability for industries and investors

A stable regulatory system is crucial. Attracting investment to create the net-zero industrial ecosystem for electromobility will be facilitated by maintaining a consistent, clear regulatory framework and climate objectives. This means first and foremost ensuring that the European Green Deal legislations as voted in the 2019-2024 mandate remain steady over time. We strongly warn against disruption of the Green Deal and their long-term planning notably by limiting the scope of major reviews. At a more granular level, we call for stability in the regulatory frameworks of all transport modes. It is a key element for successful risk management. A consistent, clear regulatory framework secondly means performing sound impact assessments before proposing new legislation. Potential legislations should be in line with the direction taken by the Green Deal as voted during this mandate. Thirdly, regulatory stability means focus on proper implementation through the swift adoption of all necessary complementary acts In a nutshell, implementing before reviewing.

2. Enhancing value chain competitiveness and resilience

a. A 360° e-mobility industry strategy

While recent European industrial policy initiatives, such as the Net Zero Industry Act (NZIA), have focused on key components and sub-systems[1], we have observed that an emphasis and consideration of full value chain competitiveness is lacking. It is crucial that these policies take into account the comprehensive nature of mobility industry value chains across sectors and support their global competitiveness as they navigate the green transitions. We call for a 360° e-mobility industry strategy, widening the focus from specific components to a more comprehensive approach, spanning from raw materials to end products and from individual to all modes of sustainable transportation.

B. Upstream and downstream

While the presence of gigafactories is fundamental for the development of green industries in Europe, with production capacity on some parts of the value chain (so far mostly focused on end products), it is important to highlight that they alone do not guarantee a competitive and non-dependant industry[2]. Indeed future industrial policy should go beyond the end-product and also consider upstream (refining) and downstream (recycling), both sectors being, so far, not located in Europe. A European industrial network of innovative companies from all sizes would help securing all stages of e-mobility value chains for the manufacturing and recycling of key components. The EU should channel purchases toward “made in Europe” products and increase production chains within Europe. Given the high demand for strategic raw material to manufacture electric vehicles, securing the value chains also includes a strong focus on security of supply of such materials and other available alternative technologies, as well as the recyclability of engines and batteries. The creation of new industrial hubs in Europe should go hand-in-hand with this strategy.

c. Energy-cost efficient strategy

Energy costs play an integral part of manufacturing competitive transport solutions. The availability of affordable, decarbonised energy is paramount to maintaining Europe’s competitiveness in the global low-carbon technology competition. We ask policymakers to work urgently on mitigating electricity prices disparities between the Union, China and the US, which are severely disadvantaging EU manufacturers. We endorse other calls[3] for the introduction of incentives that reward low-carbon technology producers favouring local materials and components.

d. Public procurement driven sectors

Similarly, for mobility sectors where investment decisions are predominantly the responsibility of public authorities, such as rail, the relevant EU legal framework must be properly enforced. That starts with public procurement, ensuring that tender evaluation criteria set the right focus on the sustainability of the selected solutions but also include all available tools to ensure fair competition, such as the foreign subsidy regulation. We strongly support the NZIA’s non-price criteria proposal in public procurement supporting sustainable development and resilient European industries. Those criteria will help favour European industries in public auctions and ultimately promote technologies produced in Europe.

e. Accompany workers and employers in skills transition

Industrial sectors must be supported in their skills development and employment policies for a successful decarbonisation of its values chains. For this purpose, EU institutions and Member States should undertake a mapping of skills shortages. This should consider both traditional and new skills. That way, we can assess the needs for jobs and skills in each sector, developing tools to identify and publicise available training, and highlight those that need to be created. Based on the identified needs, measures should be undertaken by the EU – such as NZIA’s initiative for “Net-Zero Academy” – and the Member States to support existing training structures in Member States as well as to ensure that the trainings are conducted by practitioners from companies.

3. Financing the transition in the short term: The “low hanging fruits”

Existing EU funds can already serve as valuable assets if they are distributed efficiently and intelligently, notably by streamlining access to finance, particularly for net-zero industries, through instruments such as the Innovation Fund and InvestEU. To do so, we have identified five “low-hanging fruits” measures that can be taken without further delay:

- Low hanging fruit 1: Guarantees. As a matter of priority, public investment tools should crowd in private investments by increasingly making use of instruments like guarantees. Firstly, the InvestEU Fund should be further mobilised in support of a 360° e-mobility industry strategy. Secondly, the European Investment Bank (EIB) Group should strengthen the provision of commercial bank guarantees for investments by companies across the EV value chain, replicating the recently announced €5 billion guarantee facility for the wind sector[1].

- Low hanging fruit 2: Innovation Fund. We welcome the recent initiative under the Innovation Fund to dedicate €3 billion to the EV battery value chain. This new mechanism needs to focus on the most sustainable EU battery and components manufacturers[2]. A robust mechanism needs to be built, including for channelling increased funding from Member States to match EU funding.

- Low hanging fruit 3: Capacity building. To enhance accessibility, we propose that EU or national administrations train and appoints specific staff to provide advisory services to both applicants and national authorities responsible for distributing EU funds. A substantial portion of these funds, especially in the case of Recovery funding, may remain unallocated due to the constrained administrative capacity of Member States[3] to prepare projects or process applications. Supporting project preparation and speeding up authorization procedures at the national level would thus benefit both the applicants and the authorities involved.

- Low hanging fruit 4: Mid-term MFF revision. The mid-term revision of the MFF is the opportunity for European institutions and Member States to significantly raise funds of strategic programmes (STEP but also CEF) to provide appropriate financing instruments to support a competitive decarbonisation of the EU industry and support investments in clean, sustainable mobility solutions.

3. Financing the transition in the long term: Net Zero Investment Plan

a. Why a Net Zero Investment Plan now?

The climate investment gap is deepening by the day and the way to fill the gap will be a major challenge for decision-makers in the coming years. European elections are the democratic the window of opportunity to set priorities about where EU funds should flow and the level of support that EU will provide to shift the continent to clean mobility. 2024 is thus a milestone year for the green transition. The STEP platform is, although welcomed, unfortunately far from the pan-European response to global competition on cleantech that the EU needs. Therefore, we support the creation of a major Net-Zero Investment Plan after the EU elections.

b. Predictable and upfront support for op-ex

The EU should ensure that financial instruments do not exclusively prioritise innovation but also consider the importance of providing strategic support for operating expenses and production, for a limited duration. We highlight the fact that operational expenses (op-ex) are not covered by the current InvestEU funding framework. This means that in addition to promoting innovation, financial support should be directed towards sustaining and optimizing day-to-day operations and the production processes of net-zero industries, thereby creating a more balanced approach to funding allocation. Beyond deciding the level of support that will be provided to the green and digital transition of the transport sectors, upfront predictability and certainty about possible funding should also be provided. A rulebook for financing should make sure op-ex support is both predictable and upfront.

c. Consider ventures with higher risk profiles

To complement this new approach and move closer to a truly comprehensive funding allocation, it’s essential to also consider ventures with higher risk profiles. For instance, when it comes to the Alternative Fuels Infrastructure Fund, the current financing terms are notably stringent. These terms often exclude high-risk endeavours, as they require a minimum of 50% funding from national banks or partners, effectively limiting opportunities for investment in riskier projects. This, in turn, disproportionately affects emerging industries and initiatives in Central and Eastern Europe. To address this issue, the European Investment Bank (EIB) should explore investments in riskier ventures, and InvestEU should be equipped to provide loans and equity for such undertakings. The InvestEU Program, designed to offer guarantees to both public and private banks, can play a pivotal role in enabling them to take more substantial risks in their lending and equity operations. This approach can facilitate the inclusion of ‘investments in riskier ventures’ and contribute to a more diverse and dynamic investment landscape.

d. How to finance a Net Zero Investment Plan?

This Net-Zero Investment Plan should be structured under the EU Multi Financial Framework on the one hand, and via new bond issuance programme replacing the Next Generation EU programme on the other hand. In addition, this broader investment plan should ensure that sufficient European and national funding resources, leveraging private sector investment, are available to achieve Europe’s objectives as set in the Climate Law and in the Smart and Sustainable Mobility Strategy. On top of the achievement of dedicated programs such as the TEN-T, it should include a dedicated Green Industry fund. State Aid measures should be re-designed and local supports coordinated at EU level to ensure a level playing field at European level,. The future State Aid regime should mandate EU governments to integrate environmental and social considerations to their support schemes, so that only best-in-class projects benefit from public support at regional and national level.

5. Strengthening international cooperation

Stability also requires robust international cooperation. Strengthening ties with diverse regions would diversify sources, reduce geopolitical risks and uncertainties, ensure a secure supply chain, enhance global industrial collaborations, and uphold a fair competitive environment for all clean transport industries.

- Proactively setting a Level Playing Field

The EU response to other regions’ recent green industry support program should be prepared with care, to avoid provoking a global subsidy race. The goal should be to create an international level playing field between all economies, aimed at reaching Paris Agreement climate targets (COP21) together and aligned on WTO rules. For certain industries, level playing field can only be reached by matching competitors’ support: for examples, for battery manufacturing, the US IRA provides a significant op-ex support per kWh produced; for reskilling workers, massive support for training automotive workers is proposed. We call for EU policymakers to match such support in some manner to help its European battery industry compete on more equal terms. Without such matching, there can be no global level-playing-field for e-mobility related manufacturing.

- Cooperation to avoid trade disruption

With several studies by the OECD[1] highlighting the challenges faced by European railway producers in the Chinese market, as well as the public assistance received by their companies, the question of China’s undisclosed subsidies benefiting its products is not new for the railway industry. Cooperations should be reinforced to ensure there are no such practices risking unbalancing global competition.

- Cooperation to diversify sources

Dependence on one single third country for green transport technologies is tangible[2] and should also be mitigated. China dominates the production of solar panels, batteries for EVs and part of the world trade in wind turbines. To diversify sources, we support proposals to form a green technology partnership between governments and businesses of the major economic powers to reduce strategic dependencies. Such partnership would be intended to complement, not replace, existing supply chain. Beyond cooperation with third countries, cooperation should also be within European countries and industrial partnerships to multiply joint purchases and thus secure supply of strategic raw materials at advantageous prices.

[1] President von der Leyen’s State of the Union, European Commission’s Work Programme. Executive Vice President Sefcovic’s speech at Environment Council. [2] “2024-2029: Five years to make e-mobility transition a success”, Platform for electromobility, September 2023. --- [1] A "sub-system" refers to a specialized and interconnected set of components that collectively perform a specific function within the overall system. [2] “How to Meet the Industrial Challenge of Electric Mobility in France and in Europe?”, Notes de l’Ifri, Ifri, November 2023. [3] “Call for EU Clean Industrial Deal and urgent actions to keep Europe in the world’s clean technology race”, Eurofer, October 2023. --- [1] Press Release, EIB, December 2023 [2] Press Release, European Commission, December 2023 [3] “How Europe should answer the US Inflation Reduction Act”, Bruegel, February 2023 --- [1] “Measuring distortions in international markets: The rolling-stock value chain”, OECD, February 2023 [2] “De-risking and decarbonising: a green tech partnership to reduce reliance on China”, Bruegel, October 2023.

EU Election Manifesto: A Green and Just Industrial Policy

Manifesto First Pillar

A Green and Just

Industrial European Policy

One of the richest ‘urban mines’ available to Europe is the supply of old batteries and other waste materials. By investing in integrated recycling and repurposing facilities for collecting, dismantling, recovering or reusing valuable metals from batteries, Europe can, by 2040, secure a large share of the metal resources it needs for battery production. Such an approach not just reduces waste, it is also scalable, preserving and reusing precious raw materials and keeping a greater proportion of them within Europe, increasing our strategic autonomy.

The overall concept of Europe keeping potentially valuable waste within its borders is one that should be widely adopted. Environmental recycling standards vary; exporting waste for processing to locations without equivalent standards undermines our own attempts to reduce environmental impacts. The EU should encourage recycling by establishing a harmonised approach to the intra-EU shipment of spent batteries. All. Executed properly, this can make Europe competitive in battery recycling, ensure the highest environmental standards and help create a flourishing recycling industry in the future

Resilient, affordable renewable energy will be key to a successful industrial policy; however, this demands that the correct grid assets are in place. With a European Grids Package, Europe can refresh and upgrade its infrastructure to meet the demand to accommodate higher levels of renewable energy. Although this will require investment, doing so will allow Europe to tap into its future grid asset – electric vehicles. It will accelerate the connection of chargers and other Green Deal enabling technologies and allow Europe to tap into the huge energy storage potential offered by electric vehicles.

Europe must also go further than simply reducing vehicle engine emissions; it needs a more-holistic approach to reducing the environmental footprint of all road vehicles. This means decarbonising manufacturing materials, increasing manufacturing efficiency and maximising the circularity of the materials used. Introducing digital product passports, revamping EU products policy to reduce environmental footprints and committing to deliver a strong end-of-life vehicles regulation based on low carbon and recycled materials, will be the key drivers for such change in the years ahead.

Finally, while a renewed European industrial policy has focused on key components and sub-systems, it is important that it considers the full scope of the mobility industries’ value chains supporting their global competitiveness as they address the green transitions.

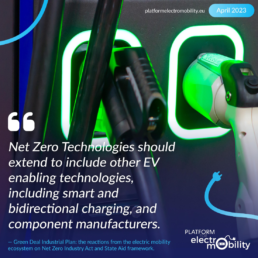

The reactions from the electric mobility ecosystem on Net Zero Industry Act

Green Deal Industrial Plan:

the reactions from the electric mobility ecosystem on Net Zero Industry Act and State Aid framework.

The Platform for electromobility welcomes the European Commission’s Net Zero Industrial Act (NZIA) and Temporary Crisis and Transition State aid Framework (TCTF) for accelerating the transition of the EU’s net zero industrial sectors towards climate neutrality by 2050. As currently proposed, the NZIA is a positive start for a necessary holistic and long-term strategic plan, detailing specific financial and regulatory support measures for addressing all global current and future challenges, securing an EU-built industrial ecosystem of sustainable transport and ensuring bespoke strategic autonomy for every key sector identified.

We understand and welcome the package of both NZIA and TCTF as a tool for accelerating clean-tech industries with proposed non-financial regulatory measures. In this paper, we outline how the narrow scope of the proposed NZIA may fail in its aim of supporting European specificities. In addition, certain financial measures should also be included; without these, the NZIA may fall short of achieving its intended goals and fail to provide the required support for European clean industries.

Scope

Given the importance of reducing greenhouse gas emissions from the transport sector and industries, and the fact that Europe’s transport systems make up part of its critical infrastructure, we consider that mobility industries that provide zero-emission vehicles (ZEV) – all transport modes considered – as well as charging stations, software and other ZEV enabling tech, should be considered part of the ‘Clean Tech’ sector.

We welcome the inclusion of battery, charging infrastructures and grid technologies in the Annexes as Strategic Net Zero Technologies, yet we remain concerned about the lack of recognition for the entire EV value chain in the proposal. Net Zero Technologies should be extended to include other EV enabling technologies, including smart and bidirectional charging as well as component manufacturers.

A more flexible approach to those sectors that will be key for the EU’s future competitiveness should be adopted. Downstream industries, such as ZEV manufacturers, should be better considered and included in the scope of the Regulation to secure economic opportunities for supported upstream industries, such as cell manufacturing. Considering the NZIA as a non-financial tool, extending the scope to other sectors of the energy transition would increase Europe’s ability to be competitive in strategic sectors for the decarbonisation of transport, without undermining the support of already-included sectors such as battery manufacturing.

Non-financial measures

To create the enabling conditions for the European clean transport industry to prosper, several issues must be urgently tackled.

The Green Deal is the EU’s centrepiece climate policy. It is now necessary to provide the regulatory certainty for businesses that will allow them to invest in the transition of the EU economy to a sustainable model that is consistent with the 2050 target of climate neutrality. Europe should lock-in ambitious Green Deal Fit for 55 policies (including the Trans-European Network for Transport Guidelines revision, the 2035 zero-emission objective for new cars and vans) and introduce similar policies for trucks and non-road mobile machinery in order to phase-out fossil trucks between 2035-40.

As specified in the proposal, and in order to ensure regulatory certainty, it is important that Member States endorse and adopt legislative and non-legislative actions relating to the Green Deal Industrial Plan. Such actions should be incorporated into national planning processes and should prioritise clean industries in energy and climate plans. New measures should also align with existing governance regulations and contribute to national energy and climate goals. National Recovery Resilience Plans should address the new elements from upcoming regulations, and the ways in which clean value chains can support energy and climate targets.

For the forthcoming mid-term revision of the Multiannual Financial Framework, we welcome recent guidelines pushing Member States to amend National Recovery and Resilience Plans towards energy independency via renewable energy deployment and greening industries. Given the strong synergies between renewable energies and electric mobility, the former will inevitably form a key pillar of a European sustainable, electric transportation system.

We welcome NZIA’s measures for reducing unwieldy bureaucracy and speeding up overly cumbersome and slow procedures for the granting of permits, through national single points of contacts and maximum durations for permitting procedures. The ‘regulatory sandbox’ approach for new technologies can also help support their faster market readiness.

More could be done, however, through a critical review of the sectoral regulation applicable to existing zero-emission industries or technologies, to accelerate product development, capacity for sustainably extracted raw materials and renewable energy, validation, certification and market access, wherever possible. Sectoral action plans could draw on the Mobility Ecosystem Transition Pathway released by the Commission in March 2022.

In order to fast-track best-in-class projects, we welcome that Member States will be required to appoint a contact person for net zero strategic projects.

For modernisation, more should be done to digitalise the approvals process and to increase expertise and skills in local and national authorities.

The Platform supports provisions oriented towards a more binding approach to sustainability / Most-Economic Advantageous Tender (MEAT). The NZIA proposes specific sustainability and resilience criteria that public authorities need to take into account during public procurement procedures, in addition to price or cost. Public authorities shall give the tender’s sustainability and resilience contribution a weight of between 15% and 30% of the award criteria. This goes beyond the only price criteria, and is aligned with the MEAT principle, which is of great importance for the transport sector.

The question of which criteria for which technology should not be tackled in great detail within the NZIA, but rather in some upcoming guidelines from the European Commission. These would support public procurement authorities grasping sustainability and resilience criteria.

In the longer term, improved coordination between universities and industries on European research strategies and priorities is essential: Europe is home of many leading research institutes, but the research sector is overly fragmented to be able to outperform some global regions in the race to develop clean tech. The role of Horizon Europe and of Public-Private Partnerships should be reinforced to address this. European research institutes are also vital in equipping the European workforce with necessary skills for the transition.

The introduction of Net Zero Academies in the NZIA goes in the right direction, but these would require more details and specification. For example, the United States’ IRA has conditionality measures to link public support with social policies at company level. The EU should support companies in their commitment for upskilling and reskilling their workforce. It should foster and promote synergies between public and private sectors, in order to create training programmes fit for the net-zero value chain, such as the ReKnow University.

Financial measures

We welcome the simplification of EU State Aid rules in terms of Aid intensity, eligible costs definition and higher thresholds for State Aid exempted from prior notification for a temporary period. This is a useful immediate measure that will support investments in the electromobility value chain in the EU.

Subsidies should be granted to projects that match a certain set of conditions. This way, public funding (to support Operational Expenditure – OpEx and Capital Expenditure – CapEx) will be directly linked to key parameters for ensuring the competitiveness and resilience of Europe’s electromobility industries for all transport modes. This will be in line with EU targets on, for example, sustainability and R&D&I as well as health, safety and environmental standards.

Specifically on batteries, we support the changes introduced in the revised Temporary Crisis and Transition Framework, which – if leveraged effectively by countries – have the potential of loosening national state aid rules to support EU-based battery production. Financial support should focus on the processing and refining of those battery materials required within the European Union. To ensure predictability and bankability for companies looking to invest in EU-based battery material production, any financing mechanism should be based on clear, pre-determined criteria and focus on output production, similar to the production-based incentives (USD/kWh) introduced by the US IRA.

However crucial the update of State Aid rules may be, the requirement to preserve a level-playing-field between European companies based in different Member States, since some are more fiscal liable and thus more likely to subside industries than others. Fragmentation of the internal market is a genuine risk:

Consequently, European competitiveness and a level European playing field require joint EU funding to ensure a pan-European investment capacity. The future European Sovereignty Fund must be established in close coordination with European clean tech industries, to ensure its cost-effectiveness, added value and complementarity with existing EU funds. ZEV-related supply chains, refining and processing materials for battery production capacity and related grid upgrades should be priority sectors for its operations, and inspiration should be drawn from the simple support provided, for example, in the US IRA, with its Advanced Manufacturing Production Credits. Without such matching of funds, there can be no global level-playing-field for battery manufacturing.

Financial measures should prioritise the development of a European battery value chain, including cell and component manufacturing, critical metals refining and processing. This should introduce minimum production targets for companies manufacturing in Europe (this can be via tax breaks or grants to scale-up manufacturing, or direct subsidies for startups who could be excluded from tax credits/deduction due to limited taxable income), uphold Europe’s environmental acquis and remain focused on the most value-added parts such as cathodes and cathode precursors. Batteries are central to scaling up ZEV and renewables. Missing this value chain to Asia or the US will undermine Europe’s strategic resilience and exclude the bloc from the resulting industrial and jobs benefits.

For battery manufacturing, the US IRA provides an Advanced Manufacturing Production Credit (Opex support) of $35/kWh produced. We call for EU policymakers to match such support in order to help its European battery industry compete on more equal terms. Without such matching, there can be no global level-playing-field for battery manufacturing.

In parallel, Europe’s competitiveness and leadership on downstream industries (road and rail vehicles manufacturing) must be enhanced through dedicated, co-created action plans. Europe should also reward an accelerated implementation of the carbon footprint, circularity and due diligence provisions in the new EU Battery regulation by targeting subsidies at companies leading on sustainability.

Funding should support urgently-needed investments in grid upgrades and capacity, training and reskilling. There should be a specific focus on ensuring that workforce shortages in the electrical and software sectors are urgently addressed. This should go beyond financial mobilisation through the existing opportunities set out by the European Commission (Innovation Fund, Invest EU, Recovery and Resilience Facility; Horizon Europe and cohesion policy programmes), which have not yet reached convincing scale or momentum. To support its ambitions, the European Commission should come forward with a concrete funding plan/guideline to support the deployment of Net-Zero Technologies.

Strengthening EU’s electromobility ecosystem in the global race.

Strengthening EU’s electromobility ecosystem in the global race.

The investment in manufacturing technologies required to develop the net-zero, clean technologies and renewable energies is urgently needed at European and global levels. The Platform for electromobility therefore welcomes the ambition shown in the European Commission’s Green Deal Industrial Plan, which is designed to improve a number of European policies in response to the new industrial ‘Inflation Reduction Act’ (IRA) in the United States.

Given the importance of reducing greenhouse gas emissions from the transport sector, and the fact that Europe’s transport systems are part of its critical infrastructure, we believe that mobility industries providing zero-emission vehicles – all transport modes considered – should be considered part of the ‘Clean Tech’ sector. This should also extended in order to include charging stations, software and other EV enabling tech, given their important manufacturing footprint in Europe. This way, it will help anchor the manufacturing facilities for EV chargers on our continent.

An effective European response should go further than the IRA, and rapidly ensure the resilience of European industries against a backdrop of growing geoeconomic challenges. These have already seen both the United States and China invest heavily to try to secure the control of the electric mobility industrial value-chain.

Together, the IRA and the Made in China 2025 (MIC) plan should be treated as a wake-up call and a trigger for a robust European response. Indeed, Europe needs a holistic and long-term strategy that sets out the specific financial and regulatory support to address all the global current and future challenges. This should be capable of securing an EU-built industrial ecosystem of sustainable transport, and should ensure bespoke strategic autonomy for each key sector identified.

Importantly, the EU response should be prepared with care, in order to avoid provoking a global subsidy race. The goal should be to create an international level playing field between all economies, aimed at reaching Paris Agreement climate targets (COP21) together.

Disregarding trans-Atlantic subsidies schemes, the European industrial strategy should define a long term-strategic ambition which, as a priority, should support the zero-emissions mobility, along its entire value chain and through all sustainable transport modes.

The Platform for electromobility is willing to bring its expertise and ecosystem perspective to the democratic debate by drafting detailed proposals that would lead way to a) short-term non-financial measures, such as regulatory certainty, bureaucratic delays, energy taxation, European research and shipment rules; b) State Aid rules and European Sovereignty Fund; and c) financial support.

EU Year of skills: making the Green Deal works for everyone

EU Year of Skills

Our recommendations to make Green Deal works for everyone

A 2021 study undertaken by the BCG looked into the opportunities and challenges created by the transition of the automotive industry towards electrification. The study shows that shift to EVs will have only a minor net impact on jobs through to 2030.

The relatively small net impact should not, however, obscure the massive structural changes resulting from electrification. Changes in production will modify both the skills requirements and distribution of labour. Over the next decade, direct employment in carmakers and ICE-focused suppliers will decrease by 5%, while the workforce in adjacent industries’ will increase by 34%. On top of this large transfer from core automotive industries to adjacent industries, a further 40k jobs will be created each year in construction and civil works for adapting energy production and distribution infrastructures needed for electrification.

By 2030, the job profile of 2.4mn positions will change, with different degrees of training needs to prepare them for future job demands, which means 42% of all employees in the core automotive and adjacent industries will have dedicated training needs. Specifically, 1.6mnwill require retraining, while remaining in their current position; another 610k will need requalification while remaining in the same industry cluster; and 225k people will need support to requalify for work in other industries outside the automotive ecosystem. Some regions – those more dependent on the traditional automotive sector – will feel this impact more acutely, so it is vital that governments provide policies and support to help those regions adapt to the coming change.

The right political and regulatory choices will help workers fully grab the upskilling opportunity created by the transition to electromobility. To support workers during this transition: the EU, governments and companies should prioritise programmes that invest in the education, training, upskilling and reskilling of the labour force to capitalise on new opportunities, raising the bar on employment conditions, to ensure no one is left behind.

The social changes triggered by the Fit for 55 should be tackled with similar levels of ambition by empowering companies, governments and regional authorities to equip the workforce with new skillsets.

Workers in the automotive sector should benefit from a policy framework similar to the Just Transition Fund, Just Transition Platform and Just Transition Mechanism for the energy-intensive industries and assist industrial stakeholders, local, regional and national authorities to:

For industrial stakeholders, support will be needed to design requalification and upskilling programmes and hiring as well as restructuring programmes. Rapid growth of adjacent industries (like battery manufacturing and charging stations operations and production) should be underpinned by ambitious requalification and upskilling and targets. Support should be provided, particularly for SMEs and fast-growing enterprises, as they will lack the analytics and training resources of bigger companies.

Relocations should be avoided where possible by adapting existing production plants, and training for new skills where they are needed. Via their industrial, attractiveness and educations competences, local and regional authorities will play a key role in addressing the knowledge gaps in the workforce. The new ESF+ should be an instrument for supporting local and regional authorities.

Governments need to perform ‘whole-of-economy’ workforce planning in close cooperation with regional and local authorities and industrial stakeholders to:

- Help employers and employees manage their transitions.

- Tailor educational curricula towards new automotive technologies.

- Build new career and employment platforms to help workers navigate to jobs and training opportunities.

- Increase student seats at universities in new automotive technologies and production/process engineering.

Source: https://web-assets.bcg.com/82/0a/17e745504e46b5981b74fadba825/is-e-mobility-a-green-boost.pdf

Our Contribution for an e-mobility friendly taxonomy

EU TaxonomyRecommendations for an e-mobility friendly Taxonomy

The members of the Platform for electromobility, which brings together more than 40 members from across all transport modes, are fully committed to promote sustainable mobility solutions and contribute to the on-going European green transition.

The Platform welcomes the EU’s initiative to establish a European Taxonomy to classify economic activities and direct public and private funding towards sustainable investments. This will be essential to achieve the ambitious climate targets of 2030 and 2050 set by the European Green Deal and the Sustainable and Smart Mobility Strategy . As transport is responsible for 27% of emissions at EU level, the European Taxonomy will play a key role in informing investors on sustainable transport activities and guiding decisions towards green investments.

Following the first reporting exercise of 2022 and the Commission’s intention to focus on the “usability” of the published Taxonomy delegated acts, the Platform would like to relay a number of observations commonly shared by its members representing the whole electromobility value chain.

- Some of the key players in the e-mobility value chain, such as the main suppliers, do not necessarily have all their economic activities covered by the taxonomy categories included in the climate delegated act, despite their significant contribution to the manufacturing of more sustainable products (BEVs, trains, etc.). This is mainly due to the fact that the taxonomy categories mainly focus on the activities of the OEMs and not necessarily on the activities of upstream suppliers[1].

- The Platform’s proposal would be to allow suppliers and subcontractors to disclose their activities in the same category as the corresponding OEM activity, particularly where these upstream activities supply single purpose technologies to be used exclusively in taxonomy-aligned assets. This would better reflect their real contribution to sustainable products, while encouraging sustainable financing of the entire electromobility value chain segments

Most of the transport activities are largely covered by the first Climate Delegated Act. Therefore, a number of companies are already preparing to report on the Taxonomy-alignment from 2023. In order to carry out this exercise, the Platform would welcome clarification on the interpretation of the Do No Significant Harm principle (DNSH) criteria on pollution and in particular on the use of substances (listed in Appendix C). These raise usability concerns, because of the difference in scope of the pieces of legislation referred to in Appendix C (notably REACH and RoHS) and the requirements of that appendix. In particular, the concept of essential use not defined in EU legislation may lead to differences in appreciations by economic operators. As a result, the information available to taxonomy users may be lacking.

- In order to avoid difficulties in proving alignment with the DNSH criteria and differences in the implementation thereof, the Platform calls for the Commission to ensure that the information gap is bridged.

- A number of delegated acts and derived documents (e.g. FAQs,) were published well after the adoption of the taxonomy regulation, even though the first eligibility reporting exercise for activities covered by the climate delegated act was required in 2022.

- The Electromobility Platform requests the stakeholders to be given appropriate time to prepare for the reporting and to have all the necessary clarifications and interpretations to fully implement all three sets of alignment criteria (substantial contribution, DNSH and minimum safeguards).

- The EC considers that the largest part of investments to complete the Trans-European Transport Network (TEN-T) is estimated to originate from public funding (national public funds, EU funds) and would amount to €244.2 billion over 2021-2050. However, to complete the core infrastructure of the TEN-T for all modes of transport, €750 billion between 2016 and 2030[2] is required. Considering the public funding contribution will cover only a limited part, a massive private investment injection will still be needed to complete the TEN-T infrastructure and achieve decarbonization objectives in the coming years.

- The Platform’s calls the European Commission to ensure a full taxonomy eligibility of electromobility members’ economic activities in order to preserve the future required investments for the e-mobility sector.

All these elements should be taken into account when amending the existing delegated acts and adopting future delegated acts & FAQs. In particular, these considerations should enhance the positive signal of the Taxonomy for electromobility technologies, which will contribute to decarbonising transport, at a time when the Green Deal objectives need more than ever to be accompanied by a coherent Taxonomy framework to finance the transition.

[1] Sometimes the NACE codes included in the Climate Delegated Act appear to be not entirely exhaustive and sometimes even misleading. [2] According to the latest Core Network Corridor Work Plans,

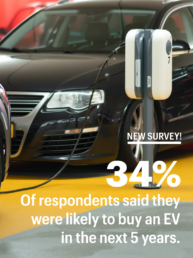

New consumer study shows that the EV transition is inevitable

New Study

European consumers want electric vehicles

The Platform for electromobility – representing more than 45 organisations from industry, civil society and cities, and across all transport modes – released a report carried out by Element Energy on consumer’s perception on the shift to electric vehicles (EV). The study, which surveyed 14,000 new car buyers across Europe shows that consumers are ready to move to electric.

Our policy recommendations

Significantly strengthen CO2 standards for passenger cars and vans targets

The importance of upfront cost in unlocking massive EV uptake highlights the need for ambitious regulation on CO2 Standards for cars and vans to ensure production scale up during the 2020s. An ambitious legislation will increase the offer and promote the market uptake of zero-emission vehicles. With an increased market, zero-emissions vehicles will also become more affordable at purchase price with a continuously reduced total cost of ownership and more choice for consumers and will also help tackle air quality and noise issues, bringing an overall benefit to society. As detailed above, the study confirms the feasibility of new proposed interim targets will be met by strong consumer demand.

Under the CO2 standards for passenger cars and vans, introduce a new provision to electrify corporate fleets

The study demonstrates the importance of corporate fleets in driving markets for electric vehicles. The Platform for electromobility therefore proposes to mandate the decarbonisation of corporate cars by 2030. In a previous communication, the group outlined the environmental and social benefits which such an EU-level mandate could bring. One major motive is for the EU to act quickly and decisively electrify a segment representing over 60% of vehicles sales in Europe and subsequently create a sufficient second-hand market by 2035 as most private consumers use this channel. To enshrine electrification objectives for corporate fleets in EU law, the Platform support the proposition by Rapporteur Huitema to revise the Clean Vehicles Directive (CVD). Its scope could be extended to corporate fleets as part of the revision of the CO2 Standards for cars and vans Regulation.

Do not introduce fuel crediting in the CO2 standards for passenger cars and vans

The study shows e-fuels as a dead-end solution for consumers. Even at a seemingly unreachable price parity with BEVs, consumers would still opt for the electric option. The Platform is opposed to introduction of a fuel crediting mechanism that would consider the contribution of renewable and low carbon fuels in the compliance assessment for each manufacturer. Policies focused on decarbonising fuels and those focused on reducing emissions from cars and vans must remain in separate legal instruments.

Under the Alternative Fuels Infrastructure Regulation, we need more ambitious targets for EV uptake

The Platform for electromobility believes the Commission’s AFIR proposal is a good start but, to ensure charging points keep up with the EV uptake, the level of ambition of the mandatory targets for light-duty vehicles must be doubled. For long distance journeys, the targets for the TEN-T comprehensive network should be brought forward to 2025.

The Energy Performance of Buildings Directive should facilitate the access to private charging

The revision of EPBD must ensure the right-to-plug to all EV users in order to facilitate the installation of charging infrastructure for tenants and properties under shared ownership. Drivers willing to make the transformation often face diverse obstacles: latency between requesting a charger and installation, installation of charging infrastructure for tenants and properties under shared ownership, lack of electrical pre-equipment in collective electrical installations etc. Smart charging is also required in all types of buildings as it provides benefits to both the power sector and the EV users. The revision of the Energy Performance of Buildings Directive is therefore very timely to address those challenges and ensure a minimum level of charging points in all off-street parking lots.

Our key findings and recommendations to make the European Green Deal an employment success

Executive Summary of the study “E-mobility: a green boost for European automotive jobs?” for policy makers

The Platform for electromobility has facilitated a report (and data set) – undertaken by the Boston Consulting Group – on the impact of the shift to electric vehicles production on automotive jobs in Europe. The Platform for electromobility represents 45 organisations from industry, civil society and cities that employ around 650,000 people globally.

This study takes a deep dive into the likely opportunities and challenges that will be created by the transformation of the automotive industry in the coming 10 years. Ensuring that workers are guided and accompanied through this transition will be the key to the success of the industry and to preparing them for the jobs of the future.

Key findings: a comprehensive and inevitable transformation

The automotive industry was deeply impacted by the COVID-19 crisis, and will likely need several years to reach pre-pandemic levels of production and profitability. Prior to the pandemic, manufacturers were producing approximately 17.7 million light vehicles in Europe with an overall production value of approximately €700 billion.

The study shows that the industry will rebound, with a shift from internal combustion engines (ICEs) to electric vehicles (EVs). By 2030, some 59% of sales in Europe will come from electric vehicles (70% if plug-in hybrids are included). Alongside electrification, digitalisation will be the second pillar underpinning the carmakers’ recovery: the study projects that the value of software included in cars will increase by 11% each year. Based on the projected volumes of production and sales for 2030, the study concludes that – across the 26 industries within scope of the research, which represent 5.7 million jobs – overall employment is forecast to remain essentially stable compared to the 2019 baseline, with minimal variations in job numbers. Although electrification will contribute in part to these slight variations, the study predicts that EVs will have only a minor net impact on jobs through to 2030, contrary to what some observers expect.

This relatively small net figure should not, however, obscure the massive structural changes resulting from the shift to electrification. Changes in production will modify both the skills requirements and distribution of labour. Over the decade, direct employment in carmakers and ICE-focused suppliers will decrease by 5%, while adjacent industries’ workforce – such as those in energy production and charging infrastructure – will increase by 34%. This transfer from core automotive industries to adjacent industries is examined in detail in the report. It shows that – with more than 580,000 new jobs created by shift to EVs – production of these vehicles will be the main driver for job creation in the automotive ecosystem.

On top of these jobs, a further 40,000 will be created each year by construction and civil works for adapting energy production and distribution infrastructures. Without the shift to EVs, these economic opportunities would not exist at all. The study also expects electromobility to act as a catalyst for further activities in other adjacent sectors to the automotive industry. In the energy domain, we expect 60,000 new jobs to be created.

Overall, the effects on employment in the core automotive sectors caused by the product changes arising from the EV shift will be compensated for by new opportunities created by the electromobility ecosystem. These will be driven, for example, by growth in battery production and charging infrastructure. This finding is all the more significant given that a failure to electrify would likely lead to competitive disadvantages and subsequent significant job losses across European industry.

The report estimates that, by 2030, 2.8 million workers will need to be hired and the job profile of 2.4 million positions will change, with different degrees of training needs to prepare them for future job demands. By 2030, 42% of all employees in the core automotive and adjacent industries will have dedicated training needs. Specifically, 1.6 million will require retraining, while remaining in their current position; another 610,000 will need requalification while remaining in the same industry cluster; 225,000 people will need support to requalify for work in other industries outside the automotive ecosystem. Some of this impact will be felt at local or regional levels, so it is vital that governments provide policies to help those regions adapt to the coming change.

Our recommendations: The need for a robust framework to master the transition

The transition to electromobility does not pose a threat but rather an upskilling opportunity for workers. With the correct political and regulatory choices, the outlook is bright for one of Europe’s strategic industries and its workforce.

It is vital to support workers during this transition to electromobility: the EU, governments and companies should prioritise programmes that invest in the education, training, upskilling and reskilling of the labour force to capitalise on new opportunities, raising the bar on employment conditions, to ensure no one is left behind. This will be an investment for future generations and for the environment.

The Platform welcomed the ambitious ‘Fit for 55’ package unveiled in July, but the social changes this will trigger should be tackled with similar levels of ambition. A fair Green Deal must empower companies, governments and regional authorities to equip the workforce with new skillsets.

European Institutions: Workers in the automotive sector should benefit from a policy framework similar to that already flourishing in the energy-intensive industries, thanks to the Just Transition Fund, Just Transition Platform and Just Transition Mechanism. This new policy framework should assist industrial stakeholders, local, regional and national authorities in accomplishing the following steps:

Industrial stakeholders: For employers – and notably carmakers – support will be needed to design requalification and upskilling programmes and hiring as well as restructuring programmes. Battery manufacturing and the deployment of infrastructure both for distribution via charging stations and production via renewable energy will be a core provider of jobs during this transition. Their rapid growth should be underpinned by ambitious regulations and targets. Support should be provided, particularly for small- and medium-sized enterprises during the transitions, as they will lack the analytics and training resources of bigger companies.

Local and regional authorities: Behind these numbers lie human lives and territories where they live. Relocations should thus be avoided where possible by adapting existing production plants, and training for new skills where they are needed. Local and regional authorities will play a key role in addressing the knowledge gaps in the workforce both for EV production and for the full EV system and value chain. The new ESF+ should be an instrument for supporting local and regional authorities in this field.

National governments: Governments need to perform holistic, ‘whole-of-economy’ workforce planning at a national level. This needs to be done in close cooperation with regional and local authorities as well as industrial stakeholders, and must include advanced models for supply and demand, such as:

- Helping employees manage their transitions. It is essential to rethink education and reskilling and provide additional initiatives; the main challenges, such as the need to requalify workers for a different industry, should receive the highest priority.

- Tailoring educational curricula appropriately. For young people entering education, Governments will need to gear them – and for job seekers – towards new automotive technologies.

- Building new career and employment platforms. The public sector should help workers to navigate to jobs and training opportunities more quickly and easily.

- Updating social safety nets. These will need to be revised in order to promote up- and re-skilling during transitions, as well as supporting part-time workers and those people unable to adapt to new challenges.

They reported our study:

-

Reuters: https://www.reuters.com/article/autos-europe-electric-jobs-idINKBN2GN26J

-

Politico : https://pro.politico.eu/news/politico-pro-morning-mobility-vw-compensation-pressure-imo-climate-neutrality-call-fit-for-55-costs?utm_source=POLITICO.EU&utm_campaign=bfe97b311b-EMAIL_CAMPAIGN_2021_09_29_04_59&utm_medium=email&utm_term=0_10959edeb5-bfe97b311b-190774208

-

Ends Europe : https://www.endseurope.com/article/1728880/ev-transition-will-minor-impact-total-auto-jobs-study-finds

-

Euractiv: https://www.euractiv.com/section/electric-cars/news/shift-to-evs-means-huge-reskilling-job-for-europe-report/

-

Automotive News Europe: https://europe.autonews.com/automakers/shift-evs-means-huge-reskilling-job-europe-study-says?utm_source=daily&utm_medium=email&utm_campaign=20210928&utm_content=hero-headline

-

Yahoo Finance: https://au.finance.yahoo.com/news/shift-evs-means-huge-reskilling-220920083.html?soc_src=social-sh&soc_trk=tw&tsrc=twtr&guccounter=1&guce_referrer=aHR0cHM6Ly90LmNvLw&guce_referrer_sig=AQAAAJrlwm12aslHP0qvGsu8voim-hoYJP2N9ur-AIvpgwL_Od1kwmrZUxk8yoc0amUzdOmXbfK66OWJ9jy0G1vdaLp9GesVGoKUybo_vJjaTEJ5YBosvGpbArsBwezSDMOcmW61uC4zosOHkYjW3Qxl44tzETmYU5DVyJqIfLevbmFx

Denmark

China:

-

MSN: https://www.msn.com/zh-tw/money/topstories/%E6%A2%85%E5%85%8B%E7%88%BE%E5%9C%A8%E4%BD%8D16%E5%B9%B4-%E5%BE%B7%E5%9C%8B%E6%95%B8%E4%BD%8D%E6%95%99%E8%82%B2%E5%8C%B1%E4%B9%8F-%E6%8A%80%E8%A1%93%E8%90%BD%E5%BE%8C%E7%89%B9%E6%96%AF%E6%8B%89/ar-AAOTh2w

-

Technews: https://technews.tw/2021/09/28/merkel-reigned-for-16-years/

-

Shenzen Daily: http://www.szdaily.com/content/2021-09/29/content_24610041.htm

UK

-

UK Investing: https://uk.investing.com/news/commodities-news/shift-to-evs-means-huge-reskilling-job-for-europe--report-2472496

-

Business Fast: https://www.businessfast.co.uk/shift-to-evs-means-huge-reskilling-job-for-europe-report/

Italy

InsideEV Italia : https://insideevs.it/news/536915/auto-elettrica-posti-lavoro-bcg/