In a previous communication,

the Platform for electromobility,

an alliance of 45 industries, NGOs and associations covering the whole value chain and promoting the acceleration of the shift to electric mobility, called for a new single regulation dedicated to the complete decarbonisation of corporate fleets. Such fleets represent 63% of new registrations and, on average, drive more than double the number of kilometres of private cars. The largest leverage for CO2 reduction with reduced political risks. The Platform recommended adopting a gradual approach to eventually reaching the objective of 100% of new vehicle purchase in corporate fleets being fully electrified by 2030.

This paper follows up on the previous communication paper with the aim of providing policy makers with the information and figures to support the drafting of such new legislation. The elements presented below are intended to aid reflection on enshrining in law and implementing the EU Smart and Sustainable Mobility Strategy’s “actions to boost the uptake of zero-emission vehicles in corporate and urban fleets”. This commitment can be made concrete through a new EU legislative framework that mandates the transition to ZEVs (Zero Emission Vehicles) for company cars.[1]

A consensus on a regulation

Although the variables of such new legislation are being debated within industries and sectors, it is certain that a Regulation, rather than a Directive, is essential for a range of reasons. A Regulation will:

- Stimulate deployment of electric mobility in those countries where uptake is currently slowest. The logic for better-harmonised measures at the EU level arises from the need for the same level of effort against climate change within all Member States.

- Avoid the delays in implementation that a Directive might entail – such as can currently be seen with the Clean Vehicle Directive. With the climate change clock continuing to tick, the time needed to conclude negotiations on a Regulation would be compensated for by the inevitability of its direct implementation. A Regulation will reduce the transition time to electric mobility between those Member States that have already announced the phase-out of ICEs by 2030 (such as Sweden, Denmark, Netherlands, and Ireland) and others.

- Bring certainty to both EV manufacturers and those companies purchasing targeted fleets. Such certainty for manufacturers, along with ambitious CO2 emission performance standards for new cars and vans, will ensure that the supply of EVs meets the EU climate ambitions and avoid companies competing for a limited supply of ZEVs.

- Introduce stronger safeguards than a Directive against potential Member State market distortions, notably in the form of unfair price increases for the private fleet owners.

Variables to consider within the Regulation and potential options

That said, a range of options for the Regulation mandating ZEVs for company cars can be considered. These include regulation application threshold, timeline, average fleet consumption or a mandate on new purchases, etc. Below, the Platform provides examples from the debate within certain Member States.

Application threshold:

There must be a balance struck between covering a large proportion of company cars in Europe while not overly impacting smaller companies, where such a mandate could become an excessive financial and administrative burden.

The Platform proposes to target the largest companies first, as it is possible to mandate the electrification of most company cars. Table 1 shows the share of company cars in Spain managed by companies, according to the size of their fleet. For example, by mandating companies managing 20+ vehicles (i.e. medium and large companies, representing only 6.8% of the total), it would be possible to electrify 55.2% of all company cars. France has already chosen such an approach (this example is detailed in Annex I of this paper).

As well as making the greatest impact with the lowest burden on the economy overall, targeting the largest fleets first would also make the implementation and enforcement of the legislation more efficient. It is easier to control and scrutinise large entities with dedicated fleet management services than it is for microenterprises. Establishing a distinction between private and business use of corporate vehicles for these smaller companies would entail onerous and disproportionate costs and an excessive administrative burden in keeping appropriate records.

Application timeline:

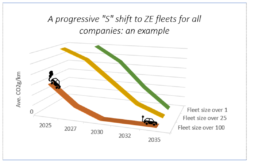

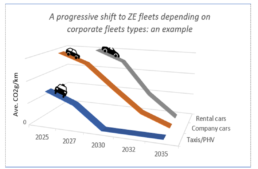

This approach would allow the adoption rate to follow an ‘S-shape’ curve, with a slow increase to 2025 due to difference in the cost acquisition of ZEVs. After 2025, and with price parity between ICE vehicles and ZEVs, the adoption rate will begin to accelerate. An EU target will provide a clear threshold for companies, while leaving flexibility for those Member States that seek to move faster towards their goal. Ideally, the mandate would apply to the fleets of the largest companies before applying to smaller fleets, given that – as time goes on – the acquisition cost of EVs will diminish and more charging infrastructure will become available.

In order to avoid social backlash, the objectives of emission reduction for 2030 were set at a moderate level. Acting more rapidly on company cars during the period 2025-30 with more ambitious levels would allow a significant impact on decarbonisation while avoid impacting those with the lowest incomes. Small- and medium-sized enterprises should be supported during the transition, as they lack the analytics and training resources of bigger companies.

Transition pace:

The steepness of the transition curve is also an element that needs to be considered. To make all newly procured corporate vehicles zero-emission by 2030 will require rapid uptake. To achieve this, there are different potential pathways (linear growth, exponential growth, ‘S-shaped’ curve, etc.), for which the efficiency, fairness and preparedness should be assessed in the impact assessment.

Enforcement, incentives and penalties:

In order to enforce the legislation, a first step would be to establish a clear reporting system to keep track of new procurement. As a next step, some type of incentive and/or penalties framework should be created. Belgium is an example of an early adopter of such fiscal incentives. The fiscal benefits for ICE company cars will progressively decrease in the country, ultimately disappearing by 2026. Meanwhile, the fiscal benefits for EVs will be maintained. In France, there is a bonus and a premium for conversion that will apply from 2022 with potential renewal.

The levels set for such variables should be discussed with industry and stakeholders throughout the legislative process and consultation phases. This political objective will be translated with specific measures in each Member State. A recent study by T&E has shown how a wide range of measures, mostly fiscal, can be activated at national level. The study showed that, once applied, such measures are effective. If Member States decide not to enforce incentivising measures for companies, then penalties may fall on those companies that fail to comply.

[1] In the document, “company cars” are defined as any passenger cars that are part of a larger fleet within the commercial market channel. There are three common categories; i) short-term rental / rent-a-car; all registrations made by rental car companies; ii) OEMs / dealers / manufacturers – demonstrators, loan cars, one-day registration, 0km, registrations made by manufacturers against themselves; iii) true fleets – all except the above categories.